social security tax limit 2021

However if youre married and file separately youll likely have to pay taxes on your Social Security income. Of course if youre a salaried worker you wont be forced to fork over that 1986480 in full.

Medicare Tax In 2022 How Much Who Pays Why Its Mandatory

Wage Base Limits.

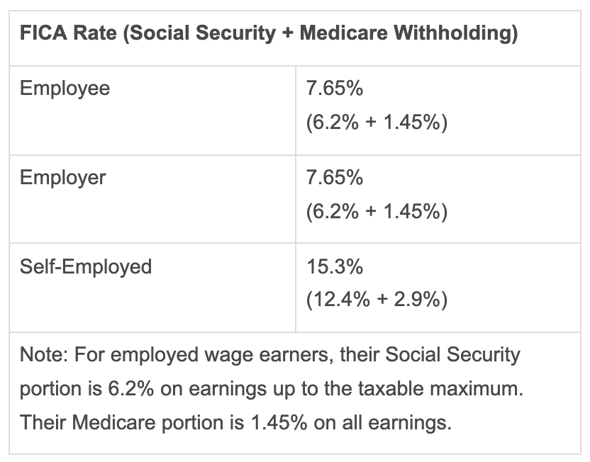

. Single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security payments for the 2021. The 765 tax rate is the combined rate for Social Security and Medicare. IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

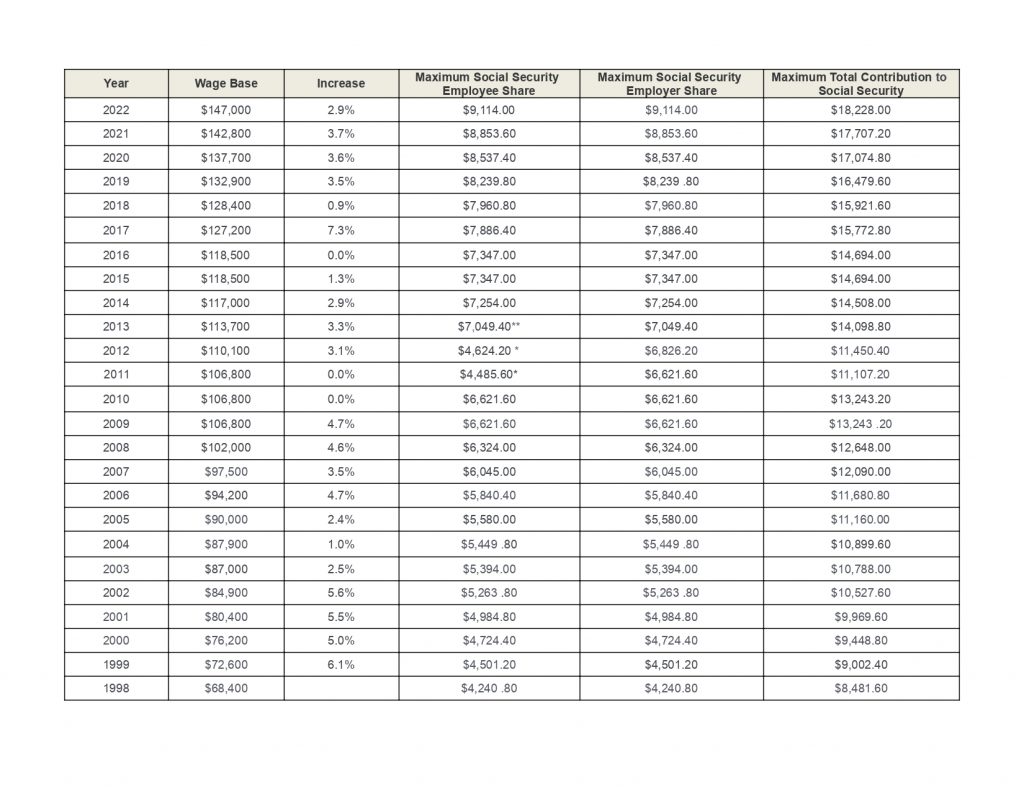

The taxable maximum for 2021 was 142800. B One-half of amount on line A. As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800.

What is the income limit for paying taxes on Social Security. The wage base limit is the maximum wage thats subject to the tax for that year. The Social Security Administration on Thursday morning announced the highest cost-of-living adjustment COLA to benefits since the early 1980s.

For earnings in 2022 this base is 147000. This amount is also commonly referred to as the taxable maximum. Between 25000 and 34000 you may have to pay income tax on.

As a result the Trustees. Only the social security tax has a wage base limit. The maximum amount of earnings subject to the Social Security tax will increase to 160200 from 147000 starting in January.

Worksheet to Determine if Benefits May Be Taxable. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax. 87The reveal comes as.

Social Security and Medicare taxes. Your employer would contribute an. The 2021 tax limit is 5100 more than the 2020 taxable maximum.

1 day agoBy contrast this years maximum Social Security tax burden was 18228. If you earned more than the maximum in any year whether in one job or more than one we only. In the decade before 2021 benefits averaged an increase of just 17.

In 2022 the Social Security tax limit is 147000 up. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must. A Amount of Social Security or Railroad Retirement Benefits.

The OASDI tax rate for. The 2022 limit for joint filers is 32000. 9 rows This amount is known as the maximum taxable earnings and changes each year.

The maximum earnings that are taxed have changed over the years as shown in the chart below. Employeeemployer each Self-employed Can be offset by income tax provisions. If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year.

SSI payment rates and resource limits January 2021 in dollars Program aspect Individual Couple. If that total is more than. For earnings in 2022.

The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. Maximum earnings subject to the Social Security tax will increase to 160200 from 147000 in 2022. By joseph June 15 2022.

We call this annual limit the contribution and benefit base. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see.

Half this tax is paid by.

Taxable Social Security Wages Are Rising For 2021 Henry Horne

Taxes And Social Security In 2020 Everything You Need To Know Simplywise

Taxes On Social Security Benefits Kiplinger

2021 Wage Cap Rises For Social Security Payroll Taxes Hr Works

What Is The Maximum Social Security Tax For 2015 The Motley Fool

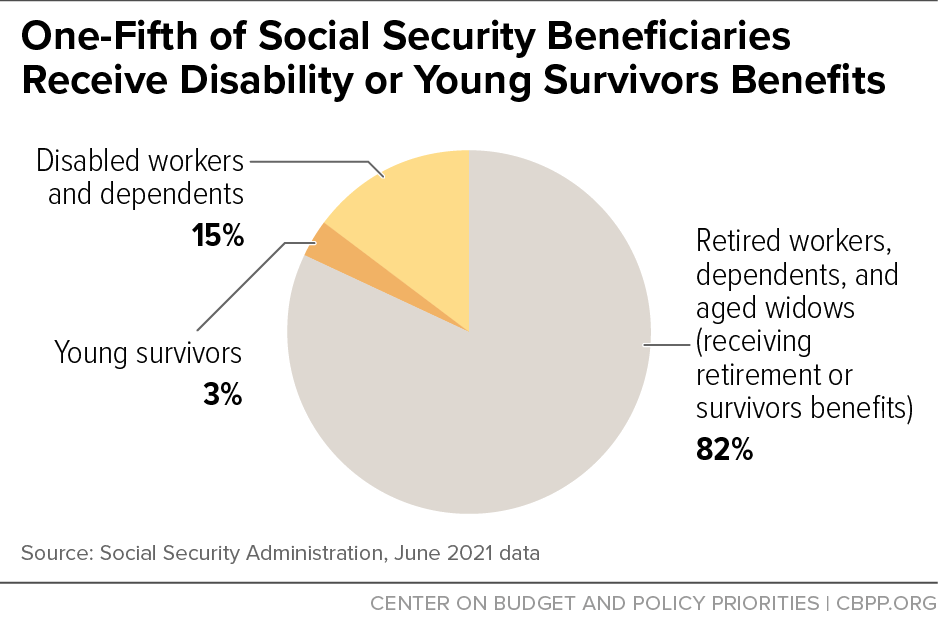

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

What Is Social Security Tax Calculations Reporting More

Taxes Payroll Taxes Especially Social Security Are Regressive Not The Homa Files

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

What Is The Social Security Wage Base 2022 Taxable Limit

When Are Medicare Premiums Deducted From Social Security

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Maximum Social Security Tax 2022 What To Know About Social Security If You Re In Your 60s ह दक ज

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap As Usa

What S The Social Security Payroll Tax Limit For 2022

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

Learn About Social Security Income Limits